- Average Copay For Prescription Drugs Without

- Prescription Copay Insurance

- Average Copay For Prescription Drugs

- Level assigned to your drug. Once you and your plan spend $4,130 combined on drugs (including deductible), you’ll pay no more than 25% of the cost for prescription drugs until your out-of-pocket spending is $6,550, under the standard drug benefit.

- (The remainder limit the use to specialty drugs—for now.) Plans attempt to detect when a patent is using copay support. Tactics include: requiring network pharmacies to submit copay program information; analyzing claims data; and mandating that prescriptions are dispensed only by the PBM-owned specialty pharmacy.

2017 Employer Health Benefits Survey

Save on Prescriptions with Prime. Search, compare prescriptions drug prices and save at over 60,000 pharmacies and Amazon Pharmacy. Save up to 80% at a pharmacy near you.

Published: Sep 19, 2017

Section 9: Prescription Drug Benefits

Almost all covered workers have coverage for prescription drugs. Over the years that we have conducted the survey, coverage for prescriptions has become more complex as employers and insurers expanded the use of formularies with multiple cost-sharing tiers as well as other management approaches. Collecting information about these practices is challenging and was burdensome to respondents with multiple plans to report on.

Beginning in 2016, to reduce burden on respondents, we revised the survey to ask respondents about the attributes of prescription drug coverage only in their largest health plan; previously, we asked about prescription coverage in their largest plan for each of the plan types that they offered. After reviewing the responses and comparing them to prior years where we asked about each plan type, we find that the information we are receiving is quite similar to responses from previous years. For this reason, we will continue to report our results for these questions weighted by the number of covered workers in responding firms. There is a more detailed discussion in the survey design and methods section on this topic.

In addition, because of the significant policy interest in access to and the cost of specialty drugs, in 2016 we also began asking employers to report separately about the cost sharing for tiers that cover only specialty drugs. In cases in which a tier covers only specialty drugs, we report its attributes under the specialty banner, rather than as one of the standard tiers. This entails revising the way we group formulary tiers: for example, a three-tier formulary where the third tier covers exclusively specialty drugs is now consider a two-tier plan with an additional tier. This approach allows us to report on the cost sharing for specialty drugs regardless of the number of tiers in the formulary. For this reason, we are not presenting statistical comparisons of estimates relying on tiers to prior years.31 This change is also discussed more fully in the survey design and methods section.

- Nearly all (99%) covered workers work at a firm that provides prescription drug coverage in their largest health plan.

DISTRIBUTION OF COST-SHARING

- A large share of covered workers (91%) are in a plan with a tiered cost-sharing formula for prescription drugs [Figure 9.1]. Cost-sharing tiers generally refer to a health plan placing a drug on a formulary or preferred drug list that classifies drugs into categories that are subject to different cost sharing or management. It is common for there to be different tiers for generic, preferred and non-preferred drugs. In recent years, plans have created additional tiers which, for example, may be used for lifestyle drugs or expensive biologics. Some plans may have multiple tiers for different categories; for example, a plan may have preferred and non-preferred specialty tiers. The survey obtains information about the cost-sharing structure for up to five tiers.

- Eighty-three percent of covered workers are in a plan with three, four, or more tiers of cost sharing for prescription drugs [Figure 9.1]. These totals include tiers that cover only specialty drugs, even though the cost-sharing information for those tiers is reported separately.

- HDHP/SOs have a different cost-sharing pattern for prescription drugs than other plan types. Covered workers in HDHP/SOs are more likely to be in a plan with the same cost sharing regardless of drug type (15% vs. 2%) or in a plan that has no cost sharing for prescriptions once the plan deductible is met (13% vs. <1%) as compared to covered workers in other types of plans [Figure 9.2].

Figure 9.1: Distribution of Covered Workers Facing Different Cost-Sharing Formulas for Prescription Drug Benefits, by Firm Size, 2017

Figure 9.2: Distribution of Covered Workers Facing Different Cost-Sharing Formulas for Prescription Drug Benefits, by Plan Type, 2017

AVERAGE COST-SHARING NOT INCLUDING TIERS EXCLUSIVELY COVERING SPECIALTY DRUGS

- Even when formulary tiers covering only specialty drugs are not included, a large share (77%) of covered workers are in a plan with three or more tiers of cost sharing for prescription drugs. The cost-sharing statistics presented in this section do not include information about tiers that cover only specialty drugs. In cases in which a plan covers specialty drugs on a tier with other drugs, they will still be included in these averages. Cost-sharing statistics for tiers covering only specialty drugs are presented in the next section.

- For covered workers in a plan with three or more tiers of cost sharing for prescription drugs, copayments are the most common form of cost sharing in the first three tiers and coinsurance is the next most common. Among those with a fourth tier, the difference between the percentage with a copayment and a coinsurance requirement is not statistically significant [Figure 9.3].

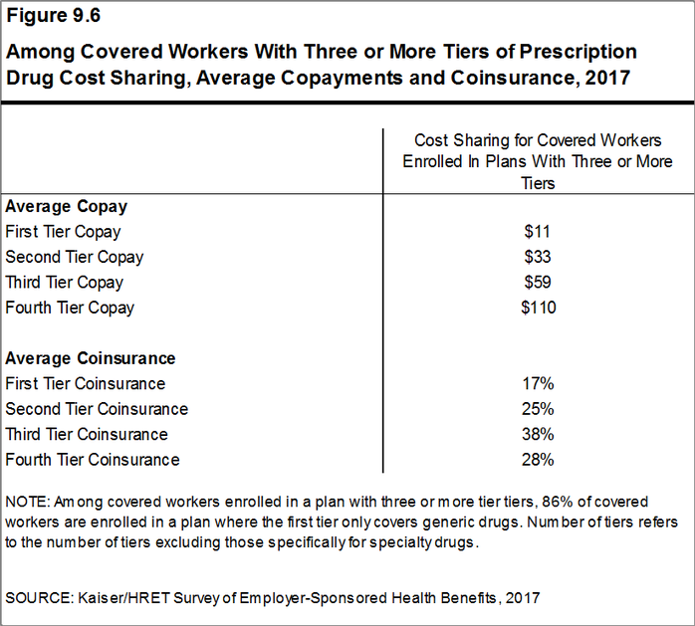

- Among covered workers in plans with three or more tiers of cost sharing for prescription drugs, the average copayments are $11 for first-tier drugs, $33 second-tier drugs, $59 for third-tier drugs, and $110 for fourth-tier drugs [Figure 9.6].

- Among covered workers in plans with three or more tiers of cost sharing for prescription drugs, the average coinsurance rates are 17% for first-tier drugs, 25% second-tier drugs, 38% third-tier drugs, and 28% for fourth-tier drugs [Figure 9.6].

- Eleven percent of covered workers are in a plan with two tiers for prescription drug cost sharing (excluding tiers covering only specialty drugs).

- For these workers, copayments are more common than coinsurance for both first-tier and second-tier drugs. The average copayment for the first tier is $11 and the average copayment for the second tier is $30 [Figure 9.3].

- Seven percent of covered workers are in a plan with the same cost sharing for prescriptions regardless of the type of drug (excluding tiers covering only specialty drugs).

- Among these workers, 21% have copayments and 79% have coinsurance [Figure 9.3]. The average coinsurance rate is 19% and the average copayment is $11 [Figure 9.7].

- Twenty-one percent of these workers are in a plan that limits coverage for prescriptions to generic drugs [Figure 9.9].

- Coinsurance rates for prescription drugs often have maximum and/or minimum dollar amounts associated with the coinsurance rate. Depending on the plan design, coinsurance maximums may significantly limit the amount an enrollee must spend out-of-pocket for higher cost drugs.

- These coinsurance minimum and maximum amounts vary across the tiers.

- For example, among covered workers in a plan with coinsurance for the first cost-sharing tier, 25% have only a maximum dollar amount attached to the coinsurance rate, 8% have only a minimum dollar amount, 18% have both a minimum and maximum dollar amount, and 49% have neither. For those in a plan with coinsurance for the fourth cost-sharing tier, 52% have only a maximum dollar amount attached to the coinsurance rate, 4% have only a minimum dollar amount, 12% have both a minimum and maximum dollar amount, and 33% have neither. [Figure 9.8].

Figure 9.3: Among Workers With Prescription Drug Coverage, Distribution of Covered Workers With the Following Types of Cost Sharing for Prescription Drugs, 2017

Figure 9.4: Among Workers With Three or More Tiers of Cost Sharing, Distribution of Covered Workers With the Following Types of Cost Sharing for Prescription Drugs, by Firm Size, 2017

American truck simulator - dragon truck design pack for mac. Figure 9.5: Among Covered Workers With Three or More Tiers of Prescription Cost Sharing, Distribution of Covered Workers With the Following Types of Cost Sharing for Prescription Drugs, by Plan Type, 2017

Figure 9.6: Among Covered Workers With Three or More Tiers of Prescription Drug Cost Sharing, Average Copayments and Coinsurance, 2017

Figure 9.7: Among Covered Workers With Prescription Drug Coverage, Average Copayments and Coinsurance, 2017

Figure 9.8: Distribution of Coinsurance Structures for Covered Workers Facing a Coinsurance for Prescription Drugs, 2017

Figure 9.9: Among Covered Workers With Prescription Drug Coverage, Coverage of Generic Drugs by Plan Design, 2017

SPECIALTY DRUGS

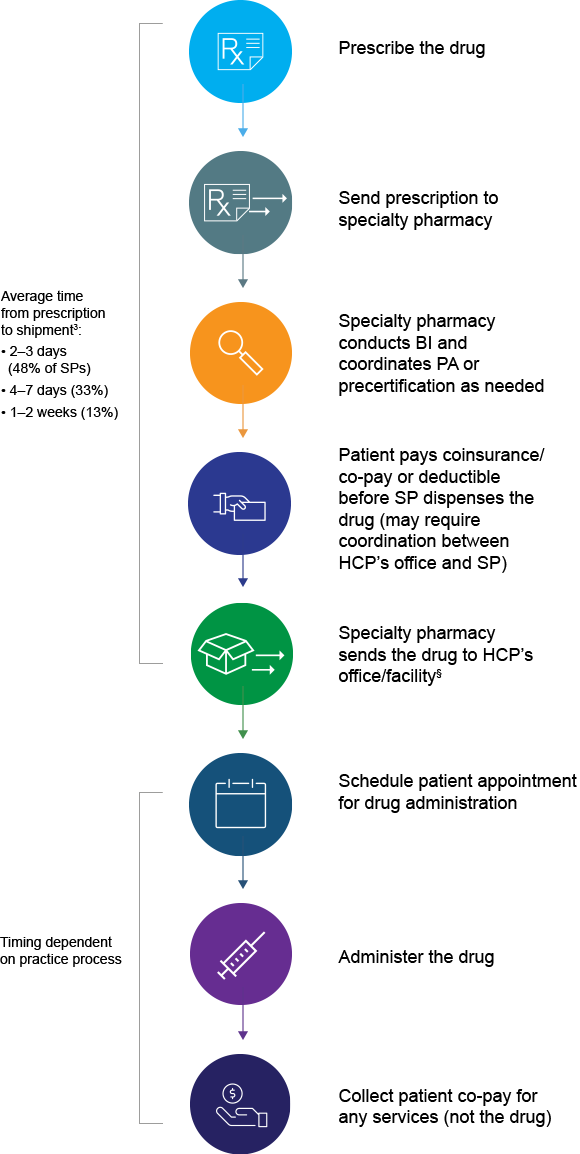

- Specialty drugs, such as biologics that may be used to treat chronic conditions or some cancer drugs, can be quite expensive and often require special handling and administration. We revised our questions beginning with the 2016 survey to obtain more information about formulary tiers that are exclusively for specialty drugs. We are reporting results only among large firms because a substantial share of small firms were unsure whether their largest plan covered these drugs.

- Ninety-seven percent of covered workers at large firms have coverage for specialty drugs [Figure 9.10]. Among these workers, 47% are in a plan with at least one cost-sharing tier just for specialty drugs [Figure 9.11].

- Among covered workers in a plan with a separate tier for specialty drugs, 45% have a copayment for specialty drugs and 46% have a coinsurance [Figure 9.12]. The average copayment is $101 and the average coinsurance rate is 27% [Figure 9.13]. Eighty percent of those with a coinsurance have a maximum dollar limit on the amount of coinsurance they must pay.

- Some covered workers are also required to meet a deductible before the plan covers specialty drugs. Among covered workers enrolled in a plan with a deductible and specialty drug coverage, 29% must meet the general annual deductible and 15% must meet a separate drug deductible before specialty drugs are covered [Figure 9.14].

Figure 9.10: Among Large Firms Whose Prescription Drug Coverage Includes Specialty Drugs, Percentage of Covered Workers Whose Plan With the Largest Enrollment Includes Coverage for Specialty Drugs, by Firm Size, 2017

/cdn.vox-cdn.com/uploads/chorus_asset/file/10813959/drug_spending_per_person.png)

Figure 9.11: Among Large Firms Whose Prescription Drug Coverage Includes Specialty Drugs, Percentage of Covered Workers Enrolled in a Plan That Has a Separate Ties for Specialty Drugs, by Firm Size, 2017

Figure 9.12: Among Covered Works at Large Firms Enrolled in a Plan with a Separate Tier for Specialty Drugs, Distribution of Covered Works with the Following Types of Cost Charing, by Firm Size, 2017

Figure 9.13: Among Covered Workers at Large Firms Enrolled In a Plan With a Separate Tier for Specialty Drugs, Average Copayments and Coinsurance, by Firm Size, 2017

Figure 9.14: Among Covered Workers Enrolled In a Plan With a Deductible and Specialty Drug Coverage, Percentage Enrolled In a Plan With Specialty Drugs Subject to a Deductible, by Firm Size, 2017

SEPARATE ANNUAL DRUG DEDUCTIBLES

- In addition to other cost sharing, some covered workers are also required to meet a separate prescription drug deductible before the plan covers some or all drugs. Fifteen percent of covered workers are in a plan with a separate annual deductible for prescription drugs [Figure 9.15]. These prescription drug deductibles are separate from any general annual deductible and may apply to all or a select number of tiers.

- For 57% of covered workers in firms with a separate deductible for prescription drugs, the deductible applies to all drugs on each of the formulary tiers [Figure 9.16].

- The average annual deductible among covered workers in firms who face a separate annual deductible is $149 [Figure 9.16].

Figure 9.15: Among Covered Workers with a General Annual Deductible, Percentage of Workers with a Separat Annual Deductible That Applies Only to Prescription Drugs, by Firm Size, 2005-2017

Figure 9.16: Percentage of Covered Workers with Drug Coverage Who Face a Separate Drug Deductible and Value of Drug Deductible, by Firm Size, 2017

- Generic drugs

- Drugs that are no longer covered by patent protection and thus may be produced and/or distributed by multiple drug companies.

- Preferred drugs

- Drugs included on a formulary or preferred drug list; for example, a brand-name drug without a generic substitute.

- Non-preferred drugs

- Drugs not included on a formulary or preferred drug list; for example, a brand-name drug with a generic substitute.

- Fourth-tier drugs

- New types of cost-sharing arrangements that typically build additional layers of higher copayments or coinsurance for specifically identified types of drugs, such as lifestyle drugs or biologics.

- Specialty drugs

- Specialty drugs such as biological drugs are high cost drugs that may be used to treat chronic conditions such as blood disorder, arthritis or cancer. Often times they require special handling and may be administered through injection or infusion.

- See the Methods Section for more information. In cases in which a firm indicated that one of their tiers was exclusively for specialty drugs, we reported the cost-sharing structure and any copay or coinsurance information under the specialty drug banner. Therefore, a firm that has three tiers of cost sharing may only have plan attributes for the generic and preferred tiers.↩

Tags

Medically reviewed by Leigh Ann Anderson, PharmD. Last updated on Sep 14, 2020.

Ask for a Generic Drug

Let’s face it - talking about health care costs is not at the top of everybody's to-do list. But with patients now responsible for more out-of-pocket dollars, it's important to consider the value of treatments. Here are 10 first steps for saving some medication money.

Not all drugs are available generically, but those that are have exactly the same active ingredients and therapeutic effects as brand name drugs, and can cost 30 to 80 percent less.

Don’t wait until you get to the pharmacy to ask for a generic – let your doctor or other healthcare provider know that you prefer generics before they write the prescription. Many popular but previously expensive medications are now available generically or even over-the-counter (OTC); focus on getting these cost-saving alternatives.

Popular but low cost generic drug or OTC classes that are now stocked at the pharmacy include:

- cholesterol-lowering statins

- non-sedating antihistamines

- certain type 2 diabetes drugs like metformin.

Research Your Medication Copays

Learn about your insurance copays or co-insurance. For example, research your 'tier copay' on your insurance website or give them a call and ask about tiers on your plan.

Copay tiers for prescription drugs can vary widely. Many plans have $10, $15 or $25 copays for generics (1st tier) or 'preferred' drugs (2nd tier), and up to $35, $50 or even $100 copays on brand name, non-formulary or non-preferred drugs (3rd tier).

- Quite often insurance will 'prefer' one or two particular drugs in a drug class because they can get it at a more affordable rate through negotiations. This is also why 'preferred' drugs are often no longer preferred at year's end, and your copay may go up.

- You can access most insurance company drug formularies on their websites. If you are still not sure what a drug might cost you, call your insurance company and ask them about copays for your prescription.

- Your pharmacist can also tell you your copay and suggest what alternatives you might have if you can't afford the prescription.

- And remember, don't hesitate to call your doctor and ask for a more affordable drug. Don't skip your medicine because of cost, if you can help it.

Talk to Your Healthcare Providers About Cost

Communication is key to understanding your insurance and getting it to work for you in the right way. Let your physician and pharmacist know you prefer lower copay drugs and generics when possible. They will work with you to find an affordable treatment.

If you have co-insurance for your prescription cost – for example, say you pay 15% of the total prescription cost – it is in your favor to get a generic or lower-tiered, 'preferred' drug, if possible. Since you pay a percent of the total cost, the lower the total cost, the lower the co-insurance portion that you pay.

Many drugs are now available without a prescription (OTC) - for example, the heartburn medications Nexium 24Hr or Pepcid Complete and the non-sedating antihistamine Claritin 24-Hr Allergy. Your insurance might not pay for OTC drugs, but it is usually less expensive than paying full price for a prescription. If you have a health savings account, you might be able to charge OTCs to that card, too.

Learn About the Medicare Prescription Outpatient Drug Coverage

Learn about and use the Medicare prescription outpatient drug coverage (Medicare Part D) if you are 65 years of age or older.

According to the FDA, five out of six people age 65 years and older are taking at least one medication, and close to 50 percent of all seniors take three or more medications. This can seriously add up.

Medicare is the national health insurance program for people 65 years of age and older or with certain disabilities. Using the option Part D Medicare coverage, copays are often just $5 or $10.

You might join the Drugs.com Medicare Support Group to ask questions, share opinions, and stay up with the latest news. Learn more at Medicare.gov.

Shop Around

Compare pharmacy prices for prescription drugs if you pay the full cash price instead of a copay.

- Prices between pharmacies can vary based on locations and volume of prescriptions.

- Check for the lowest prices - but also talk to your pharmacist who might be able to find a way to lower the cost to keep you as a satisfied patient.

- Your pharmacist can help maintain consistency with your medications, and check for drug interactions, side effects, and allergies, so it is best to keep all prescriptions at one pharmacy when possible.

Look for Patient Assistance Programs

Patient assistance programs provide free or lower-cost medications to people who cannot afford to buy their medicine.

Many pharmaceutical companies have patient assistance programs listed on their website. They may offer low- or no-cost copay coupons for certain medications, too.

You can also contact RxAssist.org, NeedyMeds.org, or PatientHelpNetwork.org – websites that offer a comprehensive listing of resources that offer assistance for low-income families. They may offer discount cards, as well.

Ask for Free Medication Samples

Consider checking with your doctor to see if they have free samples of your prescription medications.

- Often, doctors will have full size samples they can pass along, especially for maintenance medications such as asthma inhalers or blood pressure medications.

- These may be brand name products that do not have a generic available yet, so ask your doctor if you will be able to substitute a generic when needed. If not, you may be paying out-of-pocket for a very expensive brand name drug after your sample runs out.

- Don't pay for an expensive brand name drug if an equally effective generic is available. If you're not sure, ask your doctor or pharmacist.

Seek Out Low-Cost Generics

- Look for pharmacies that offer low-cost generic drugs.

- Some retail pharmacies have a generic list of drugs on their website with costs as low as $4.00 for a 1-month supply or $10 for a 3-month supply.

- To get the lower cost 3-month supply, your doctor may need to actually write your prescription for a 90-day supply, so ask for that during your visit.

- Some retail grocery store chains even offer certain free genericantibiotics or other classes, be sure to ask.

- Show your $4 or free lists to your doctor to see if there are any options on the list for your specific condition.

- If you have the option to order medications via the mail (mail order pharmacy), this can save you money (and time), too. But you may have to buy a 3- or 6- month supply of maintenance medications like diabetes treatments or antidepressants, as mail order pharmacies often only sell drugs in bulk. If you're not sure you'll stay on the medicine, this might waste money and medicine, as you can't return it.

- Finding a medication that you can afford so you are able to take it as prescribed is very important. Look for generic over-the-counter (OTC) and store brand medications, too.

Discount Coupons: Don't Leave Home Without Them

Seek out online (but reliable) coupon codes and discount cards that can save money for your specific medication; these usually work if you're paying cash.

- Take the discount code or card to the pharmacist (or show it on your phone) and they can usually enter the code to gain the discount for you.

- Pharmacies are getting more comfortable with accepting these discount cards, but not all of them. You might want to call before you drive over.

- Keep in mind, some pharmacies may not honor coupon codes for controlled substances like opioid pain or anxiety medications.

If you find that a prescription cost is simply out of reach, ask your pharmacist if they can contact the doctor to determine a less expensive alternative. In most instances, a comparable medication that is lower in cost can be prescribed for your condition.

Finally, think about asking for a discount at the pharmacy counter. Many chain pharmacies have in-house prescription discounts they can offer, although you may have to pay a small fee. These plans can often save $10 or more per prescription.

Only Buy Reliable and Trustworthy Medications

While it may be a tempting way to save money on medications, do not buy prescriptions from foreign countries or from unreliable websites on the Internet. What you might save in dollars can be costly to your health.

- According to the U.S. Food and Drug Administration (FDA) “the safety and effectiveness of imported drugs have not been reviewed by the FDA, and their identity and potency can't be assured.”

- You could receive the wrong drug, the wrong strength, fake drugs, or even outdated, expired medications.

- The FDA’s BeSafeRx can help you identify and avoid fake online pharmacies.

Finished: Top 10 Ways to Save Money on Your Medication Costs

Grapefruit and Medicines - A Possible Deadly Mix?

Grapefruit and grapefruit juice can affect hundreds of prescription medications and can lead to important and serious drug interactions. Does grapefruit juice alter any medications you are taking?

Memos on Menopause - What Every Woman Needs to Know

Society tends to treat menopause as a disease; something to be avoided at all costs. But menopause can be positive. No more monthly mood swings, period accidents, or pregnancy worries. Self-confidence and self-knowledge at an all-time high. Find out why menopause should be embraced.

Average Copay For Prescription Drugs Without

Sources

Prescription Copay Insurance

- FDA. Generic Drug Facts. Accessed Sept. 14, 2020 at https://www.fda.gov/drugs/generic-drugs/generic-drug-facts

- Consumer Reports. Same Generic Drugs, Many Prices. Accessed Sept. 14, 2020 at http://www.consumerreports.org/cro/magazine/2013/05/same-generic-drug-many-prices/index.htm

- FDA. BeSafeRx: Know Your Online Pharmacy. Accessed Sept. 14, 2020 at https://www.fda.gov/drugs/quick-tips-buying-medicines-over-internet/besaferx-know-your-online-pharmacy

Further information

Average Copay For Prescription Drugs

Always consult your healthcare provider to ensure the information displayed on this page applies to your personal circumstances.